Medicare & Short and Long Term Care

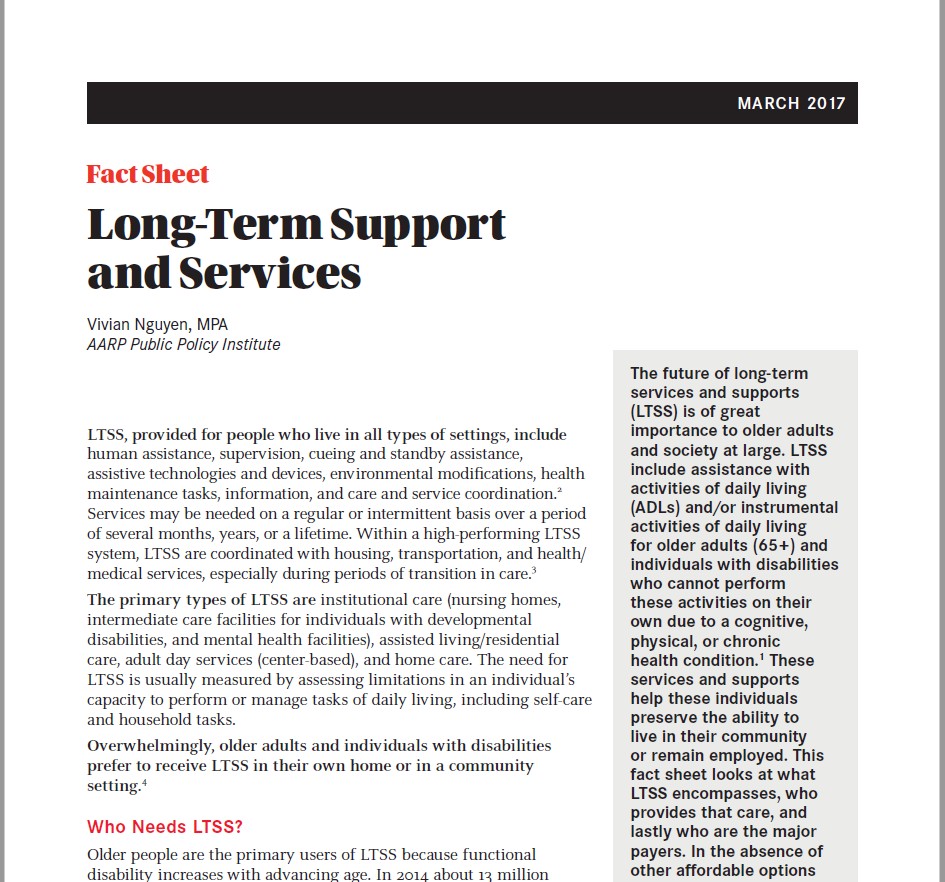

20 percent of people over the age of 65 will need long term care for longer than 5 years

You may planned out your retirement but have you thought about living longer and what extra care you may need as you age? It may be time to think about short term and long term care insurance. Have you asked yourself any of these questions:

- What is the difference between long term and short term insurance?

- Will this affect my or my spouses social security income?

- What happens if I want to cancel this policy after I have paid into it?

- What happens if I become impaired to the point I need full time care?

- Does the policy pay out cash or does it reimburse our costs?

20 percent of people over the age of 65 will need long term care for longer than 5 years

You may planned out your retirement but have you thought about living longer and what extra care you may need as you age? It may be time to think about short term and long term care insurance. Have you asked yourself any of these questions

Helpful Resources

After looking at our resources you may have some questions that pertain to your specific situation. Floyd can provide you simple answers and experienced guidance from over 30 years providing health insurance. Reach out in the form below to talk with Floyd about your insurance questions.

Floyd can provide you simple answers and experienced guidance from over 30 years providing health insurance. Reach out in the form below